We all have our monthly grocery expenses, but wouldn’t it be great to save on those purchases? If you shop at Walmart frequently, you’re in luck. There are a number of different ways to earn cash back at Walmart, whether you shop online or in-person.

Earning cash back on your regular Walmart shopping can take a little extra effort, but the added time you spend could translate into serious rewards. Here’s how to earn Walmart cashback through various methods that any Walmart shopper can use.

Ibotta

Ibotta is a free coupon app that gives its users the opportunity to earn cash back at selected retailers. Through Ibotta, you can learn how to save through a few different methods.

- Earn in-store: You can search the app for coupons, add the deals to your profile, upload a photo of your receipt, and you will have cash back within 24 hours in your account.

- Link your loyalty account: If you don’t want to hassle with receipts, you can simply link your loyalty account from participating retailers. However, Walmart does not have a loyalty or rewards program, so this won’t be an option at their stores.

- Shop online: If you enjoy shopping online, you can earn cash back at Walmart or other retailers by simply clicking through the Ibotta app or website.

At time of publishing, you can earn up to 5% back on select shopping categories at Walmart such as:

- Fashion, jewelry, and watches

- Auto

- Sporting goods

- Baby

- Health and beauty

- Lawn and garden

If you aren’t shopping in any of these categories, you can still earn 1% cash back on any category not listed. However, the following categories are restricted from earning any cash back:

- Everyday living

- Home

- Tires

- Personal care

- Household

If you’re shopping in-store, you can search through a long list of digital coupons to use to help you save money, including deals on groceries, home items, and toiletries.

In summary, to earn cash back using Ibotta, you can either earn in-store or by shopping online. It doesn’t require hardly any extra effort, and it could lead to great cash back over the long run.

Capital One Shopping

Capital One Shopping1 is an easy-to-get browser extension that may help you save money when you shop online. It's completely free, and currently available for Google Chrome, Mozilla Firefox, Microsoft Edge, and Safari. When you shop with a participating retailer, Capital One Shopping scans the web for coupon codes and great deals, and it alerts you if it's able to find a better price on an item in your shopping cart. It works across thousands of online retailers, so whether you're shopping at Walmart.com or another participating retailer, you can feel confident you're getting a good price.

In addition to potentially saving money with Capital One Shopping, you can also use it to earn rewards. When you make purchases on qualifying sites, you earn Capital One Shopping Credits, which can be redeemed for gift cards to popular online retailers.

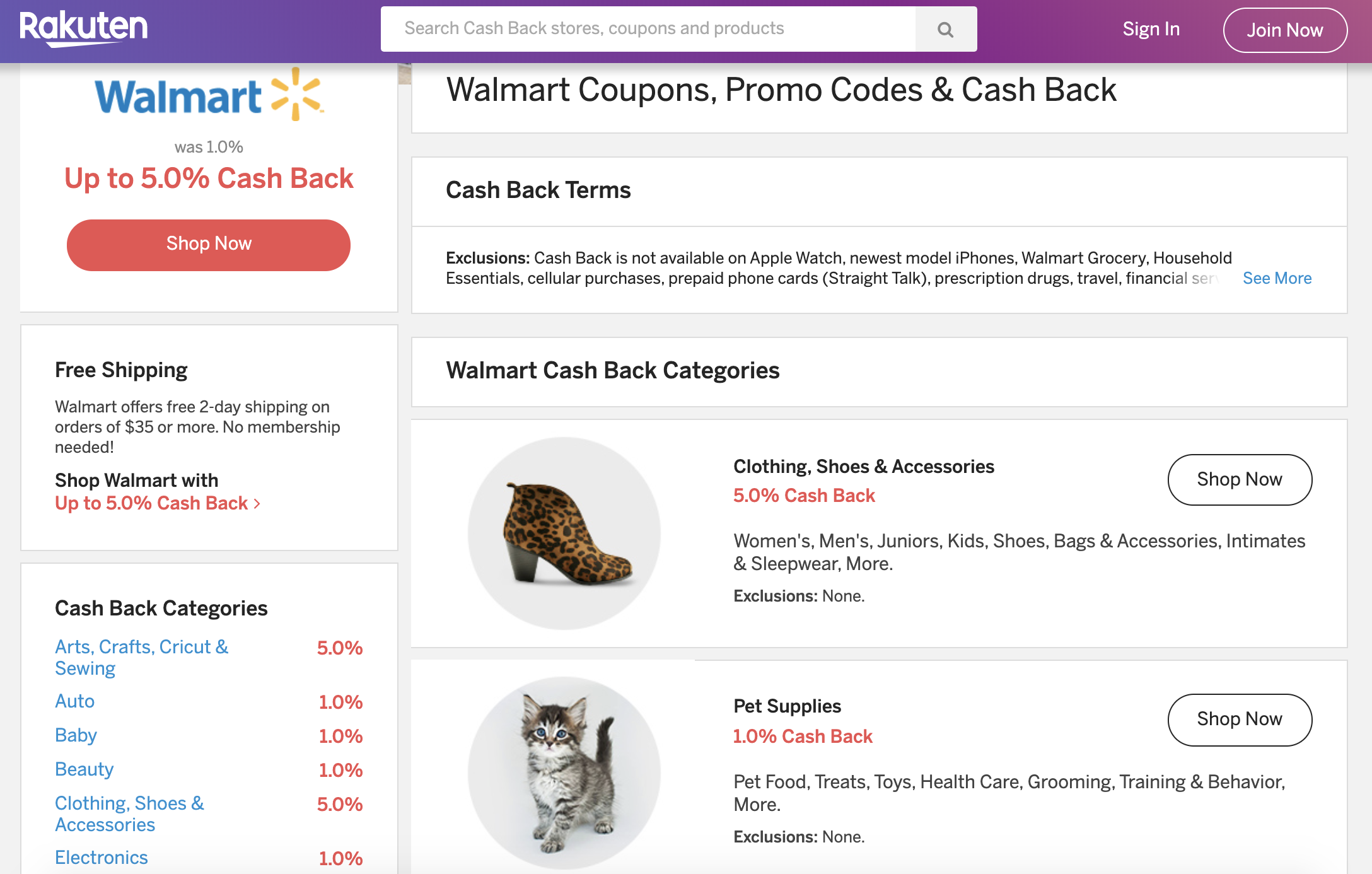

Rakuten (formerly Ebates)

Very similar to Ibotta, Rakuten is an even larger cash back platform with the world’s largest selection of products and services. It also offers special coupons and rebates at major retailers like Target, Apple, and Amazon. Rakuten has saved its members over $1 billion dollars to date, and you can be a part of the savings as well with your Walmart purchases.

If you shop at Walmart.com, you can very easily earn as much as 5% cash back on your purchases through Rakuten. Before you shop, simply search for Walmart in the Rakuten app or site, hit the red button that says “shop now,” and it will redirect you to the Walmart.com home page.

Similar to Ibotta, there are exclusions and terms that need to be abided by to earn rewards. Categories such as clothing, arts and crafts, office supplies, camping, and sports currently earn up to 5%. Other categories earn around 1% back.

Fetch

Fetch is a free app that rewards you when you purchase certain items and upload your receipts to the app. Simply download the Fetch app for your Android or iOS device, create an account using your email, Facebook, or Google info, and start using it for your Walmart shopping trips. Earning rewards with Fetch is simple. When you purchase a qualifying grocery or household item and upload your receipt to the Fetch app, you'll earn points on those items.

Not only can you use Fetch to earn rewards when you shop at Walmart, but you can also redeem your points for Walmart gift cards. You'll need to earn 3,000 points to cash out your Fetch rewards, but if you use Fetch regularly, your points can add up and save you some money when you shop at Walmart.

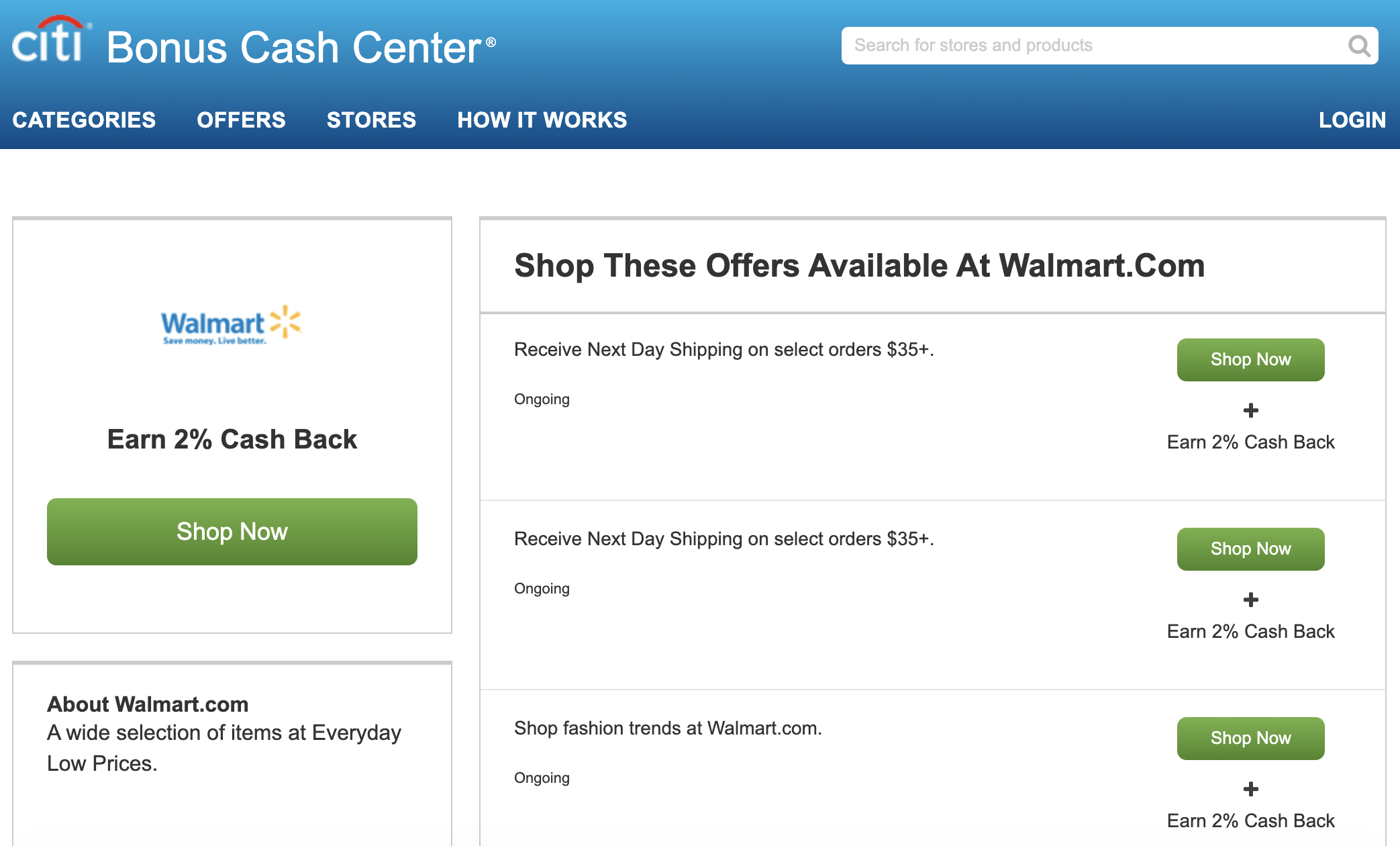

Citi Bonus Cash

If you hold an eligible Citi credit card such as the Citi Double Cash® Card, you can use Citi Bonus Cash to get cash back at Walmart.

To earn extra cash back on Walmart.com purchases, all you need to do is log in to your Citi account and access the Bonus Cash Back Center website. From there, you can search for Walmart and then access Walmart.com from the large “shop now” button on the left.

From here, you can earn up to 2% bonus cash back on eligible purchases when you use your Citi card to pay. For further info on what purchases are eligible, simply scroll down for further details on the current offers.

Cashback aggregate sites

To be a savvy online shopper means using a cashback aggregate site. These sites collect data about the best earnings at that moment for large retailers. This is a great way to get started with stacking rewards to earn/save you even more on your normal purchases.

For example, CashbackMonitor.com aggregates all of this info into one page where you can decide the discount that is best for you.

At time of publishing, Walmart.com purchases were eligible to earn a vast amount of cash back or even airline points, if you choose.

Once you select which option best suits your needs, simply click it and you’ll be routed to the correct site. Once you make your Walmart purchase, you will earn the subsequent award in the account you have chosen.

For example, if you choose JetBlue ShopTrue and make an eligible purchase of $100, you will earn 300 JetBlue points.

Of all the different strategies of how to earn cash back at Walmart, this is by far the simplest and most flexible. It takes just a few extra clicks to be on your way to cash back or valuable frequent flyer miles to get you free flights.

Honey

Honey is one of my favorite ways to find discount codes and discounts online. Similar to Capital One Shopping, it’s a simple browser extension that you can install for free. It automatically searches for digital coupons that can be applied to your online order. At some retailers, you can also earn “Honey Gold” points, which can be redeemed for gift cards.

At time of publishing, Honey was offering 1-3% in Honey Gold rewards for Walmart.com purchases. Once you have earned 1,000 Gold (equivalent to $10 in cash back), you can then redeem your Gold for gift cards to large retailers such as Amazon or Walmart.

Walmart Capital One credit cards

If you do a significant portion of your shopping at your local Walmart, consider applying for one of the two available Walmart credit cards.

With the Capital One Walmart Rewards® Card, you can earn 5% back at Walmart.com, on the Walmart app, and on Walmart pickup and delivery; 2% back in Walmart stores, at Walmart and Murphy USA gas stations, on gift cards at Walmart, and on restaurant and travel purchases; and 1% back on everything else.

There’s also a great introductory offer on this card. Earn 5% back on purchases in Walmart stores for the first 12 months when you use this card with Walmart Pay as a cardmember.

If you do decide to apply for a Walmart credit card, it is always best practice to pay off your statement balance in full. If you leave a balance and are accruing interest, that can quickly negate any cash back you are earning. If you don’t do a majority of your shopping at Walmart, consider other cashback credit cards.

Best credit card to use for cash back at Walmart

If the Walmart credit cards don’t suit your needs, there are plenty of other cashback credit cards that can help you save on your shopping trips at Walmart.

U.S. Bank Shopper Cash Rewards™ Visa Signature® Card

The U.S. Bank Shopper Cash Rewards™ Visa Signature® Card allows you to earn 6% cash back on first $1,500 in combined eligible purchases each quarter with your choice of two retailers; 5.5% cash back on prepaid hotel and car reservations booked directly in the Rewards Travel Center; 3% cash back on the first $1,500 in eligible purchases in one everyday category; and 1.5% cash back on all other eligible purchases. And one of the retailers you can choose for the 6% cash back is Walmart.

This card also has an intro bonus that allows you to earn $250 after spending $2,000 on eligible purchases in the first 120 days. The annual fee is $95 (waived first year).

Learn more in our U.S. Bank Shopper Cash Rewards card review.

Discover it® Cash Back

The Discover it® Cash Back card has revolving spending categories where you can earn 5% cash back on everyday purchases at different places you shop each quarter like grocery stores, restaurants, gas stations, and more, up to the quarterly maximum when you activate, plus unlimited 1% cash back on all other purchases. Occasionally, Walmart.com is part of the rotating categories.

To add to the savings, Discover will match all of the cash back you earn in your first year of card membership. For example, if you were to earn $330 in cash back on all your spending, Discover will match that and bring your final total to $660.

Lastly, you will have a 0% intro APR on purchases for 15 months (then 17.24% to 28.24% (variable)) and a balance transfer intro APR of 0% for 15 months (then 17.24% to 28.24% (variable)).

Citi Double Cash® Card

The Citi Double Cash® Card will earn 2% on every purchase with unlimited 1% cash back when you buy, plus an additional 1% as you pay for those purchases; plus, for a limited time, earn 5% total cash back on hotel, car rentals and attractions booked on the Citi Travel℠ portal through 12/31/24. This is also one of the best credit cards for groceries, as your earnings will always be a consistent up to 2% cash back.

To add to the savings, you will have an intro 0% APR on balance transfers for 18 months (then 19.24% - 29.24% (Variable)). You can use a balance transfer to help pay off debt even quicker than you would if you keep your debt on a credit card accruing interest.

Chase Freedom Unlimited®

The Chase Freedom Unlimited® has an easy-to-earn sign-up bonus — you can earn unlimited matched cash back. Use your card for all your purchases and at the end of your first year, Chase will automatically match all the cash back you earned (there is no limit to how much you can earn; every dollar in cash back rewards you earn is a dollar Chase will match).

You’ll also earn 5% cash back on travel purchased through Chase Ultimate Rewards®, 3% cash back on drugstore purchases and dining at restaurants, including takeout and eligible delivery services and unlimited 1.5% cash back on all other purchases. Along with cash back, you’ll have an intro 0% APR on purchases for 15 months (then 20.49% - 29.24% Variable).

Also, if any of your purchases at Walmart do go awry, you will have purchase protection and extended warranty protection when you use the Chase Freedom Unlimited to pay, along with a host of other included benefits.

Our list of the best cashback credit cards is a great resource as you search for the right card for you.

FAQs about how to earn cash back at Walmart

What are the best ways to earn cash back at Walmart?

The right credit cards and cashback apps can help you maximize your cash back at Walmart.

Ibotta and Rakuten are two cashback tools that provide you with as much as 5% back on certain purchases. Cashback aggregate websites such as CashbackMonitor.com help you determine which specific sites will provide the most money back.

Some credit cards also provide more cash back for Walmart purchases than others. This includes Walmart credit cards and others such as the Discover it Cash Back. You can double dip and use a cashback app while also paying with these cards to get the most money back on your Walmart purchases.

Which credit card earns cash back at Walmart?

The Capital One Walmart Rewards® Card provides 5% back at Walmart.com, on the Walmart app, and on Walmart pickup and delivery; 2% back in Walmart stores, at Walmart and Murphy USA gas stations, on gift cards at Walmart, and on restaurant and travel purchases; and 1% back on everything else.

Other cards, such as the Discover it Cash Back, offer revolving spending categories where you can earn 5% cash back on everyday purchases at different places you shop each quarter like grocery stores, restaurants, gas stations, and more, up to the quarterly maximum when you activate, plus unlimited 1% cash back on all other purchases. Walmart.com has been one of those categories in the past.

In addition to the cards offering bonus cash back, any card that provides cash back for big box store purchases or for general purchases will allow you to earn cash back at Walmart as well.

What credit score do I need for a Walmart Rewards Card?

To get approved for a Walmart Rewards Card, you'll likely need good to fair credit. A fair FICO credit score falls within the 580-669 range.

Which apps let you earn cash back at Walmart?

Many different cashback apps allow you to earn cash back for purchases at Walmart. Ibotta offers up to 5% back on select purchases, as does Rakuten — both of which are cashback websites. Honey, which is a browser extension that searches for discounts and allows you to earn Honey Gold points, also provides points for shopping at Walmart.com.

Because there are many different sites, using a website such as CashbackMonitor can help you to find which ones are providing the most cash back at the time of your purchase.

How to use these deals to earn cash back at Walmart

There are a seemingly infinite amount of ways to save money shopping online, and these are just a few ideas to jumpstart your savings while shopping at Walmart. As e-commerce continues to become the preferred method of shopping, more strategies will surface and make online shopping that much better.

If you want to begin stacking rewards, consider combining a cashback rewards platform like Ibotta or Rakuten and a cash back credit card like the Citi Double Cash Card to work simultaneously. Stacking rewards like this can lead to significant savings at the Walmart checkout or with any other large retailer. All these methods for saving can help you learn how to manage your money better and get ahead faster.

/static-assets/production/static-163e118e6b25d06c642fb720b8489985a907b750/images/financebuzz.png)

/images/2018/01/23/navina-side-hustle-mid_MPfEDfV.jpg)

/images/2019/12/06/smart_strategies_to_save_money_on_car_insurance.jpg)

/authors/brett-holzhauer_MFcfJxO.png)

/authors/gabriela-walsh-headshot.png)

/images/2019/11/18/earn_serious_cashback_at_walmart.jpg)

/images/2020/10/20/capital-one-shopping.png)

/images/2023/01/09/rakutenrewards-logo-clearspace-digital-purple.png)

/images/2023/11/14/chase-freedom-unlimited-nov-2023.png)

/authors/brett-holzhauer_MFcfJxO.png)